Instant Insights & Automate Tasks

Norric's Analyst is the most advanced autonomous co-worker for real estate, transforming deal cycles and data-driven decisions with speed and precision.

Modes Customized for Your Workflow

We built diverse algorithms and underlying models for specific tasks and workflows to produce stronger, more tailored outputs.

Evaluate Mode

Evaluates and provides quick, data-driven answers by summarizing zoning laws, feasibility assessments, and property-specific details.

Draft Mode

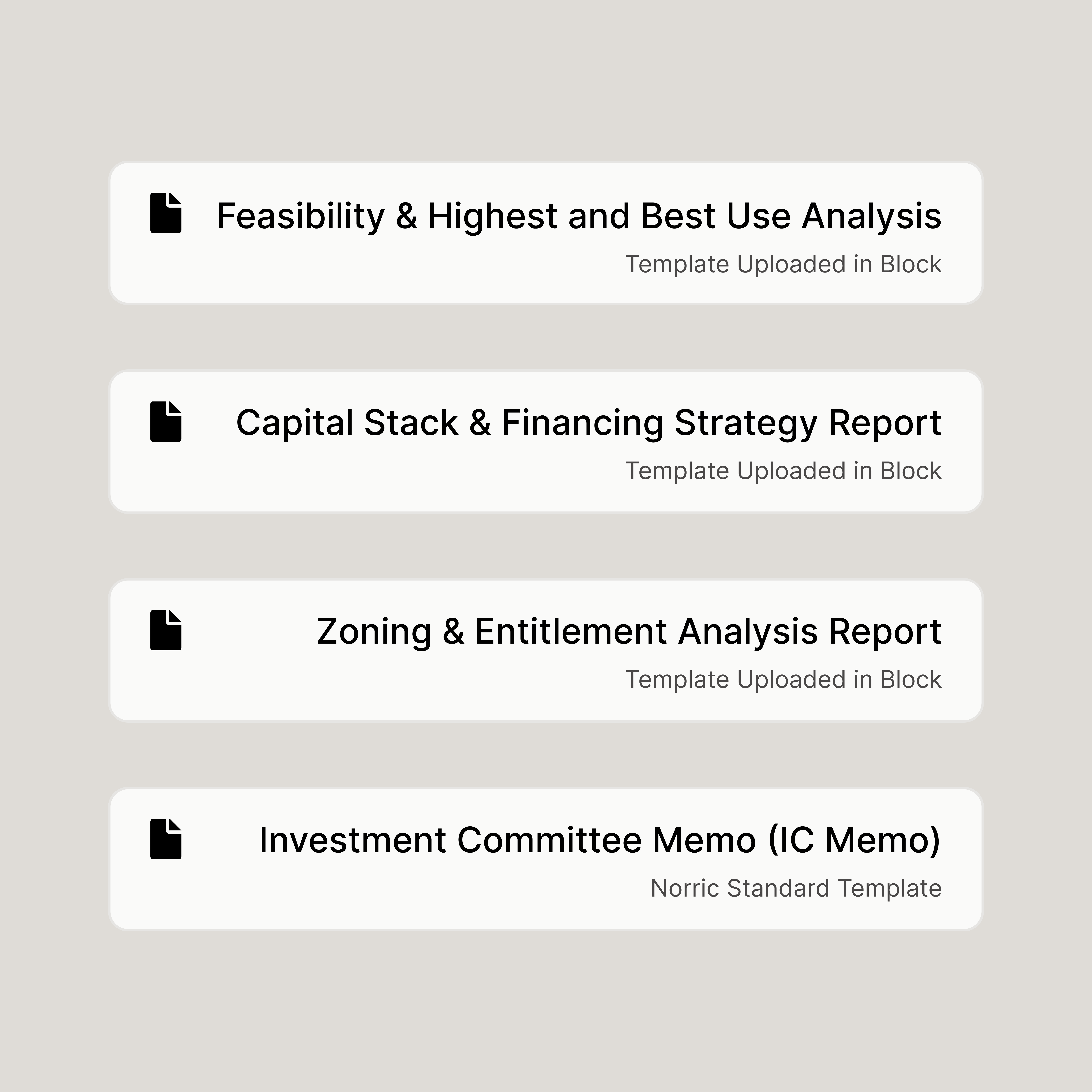

Transforms insights from Evaluate Mode into long-form documents, research briefs, and structured reports.

Assist Mode

Refine responses, ask targeted follow-up questions, and receive AI-driven suggestions for deeper insights—allowing users to brainstorm and iterate.

Conversational AI

Enables seamless personalization, allowing firms to engage with Norric like a traditional analyst—refining theses, generating reports, and crafting memos effortlessly.

Frequently asked questions

What does the AI Analyst do?

First, it automatically ingests, standardizes, and labels company information from multiple data sources provided via file upload or external data room integration, including free-form Excel spreadsheets. This information is further enriched with public third-party data and proprietary data from a repository of the lenders’ prior deals to produce a screening dashboard. Next, it completes a credit analysis tailored to the lenders’ credit parameters, outputting one or more customizable credit reports. These reports help lenders better assess how well a given company fits their credit box, benchmark the opportunity against relevant companies, and understand performance risks.

What does the AI Analyst do?

First, it automatically ingests, standardizes, and labels company information from multiple data sources provided via file upload or external data room integration, including free-form Excel spreadsheets. This information is further enriched with public third-party data and proprietary data from a repository of the lenders’ prior deals to produce a screening dashboard. Next, it completes a credit analysis tailored to the lenders’ credit parameters, outputting one or more customizable credit reports. These reports help lenders better assess how well a given company fits their credit box, benchmark the opportunity against relevant companies, and understand performance risks.

What does the AI Analyst do?

First, it automatically ingests, standardizes, and labels company information from multiple data sources provided via file upload or external data room integration, including free-form Excel spreadsheets. This information is further enriched with public third-party data and proprietary data from a repository of the lenders’ prior deals to produce a screening dashboard. Next, it completes a credit analysis tailored to the lenders’ credit parameters, outputting one or more customizable credit reports. These reports help lenders better assess how well a given company fits their credit box, benchmark the opportunity against relevant companies, and understand performance risks.

What does the AI Analyst do?

First, it automatically ingests, standardizes, and labels company information from multiple data sources provided via file upload or external data room integration, including free-form Excel spreadsheets. This information is further enriched with public third-party data and proprietary data from a repository of the lenders’ prior deals to produce a screening dashboard. Next, it completes a credit analysis tailored to the lenders’ credit parameters, outputting one or more customizable credit reports. These reports help lenders better assess how well a given company fits their credit box, benchmark the opportunity against relevant companies, and understand performance risks.

What does the AI Analyst do?

First, it automatically ingests, standardizes, and labels company information from multiple data sources provided via file upload or external data room integration, including free-form Excel spreadsheets. This information is further enriched with public third-party data and proprietary data from a repository of the lenders’ prior deals to produce a screening dashboard. Next, it completes a credit analysis tailored to the lenders’ credit parameters, outputting one or more customizable credit reports. These reports help lenders better assess how well a given company fits their credit box, benchmark the opportunity against relevant companies, and understand performance risks.

We’re building a future where real estate analysis that once took weeks can be done in minutes.

Through partnerships with leading real estate developers, institutional investors, and private equity firms, Norric is redefining how AI is applied to real estate decision-making.