AI-Powered Document Integration

Firms rely on thousands of pages of internal documents, financial models, zoning regulations, and legal contracts to make informed decisions.

Upload, Store, and Analyze Thousands of Documents

Block enables firms to seamlessly upload, connect, and analyze documents, extracting key insights in real time without manual sorting.

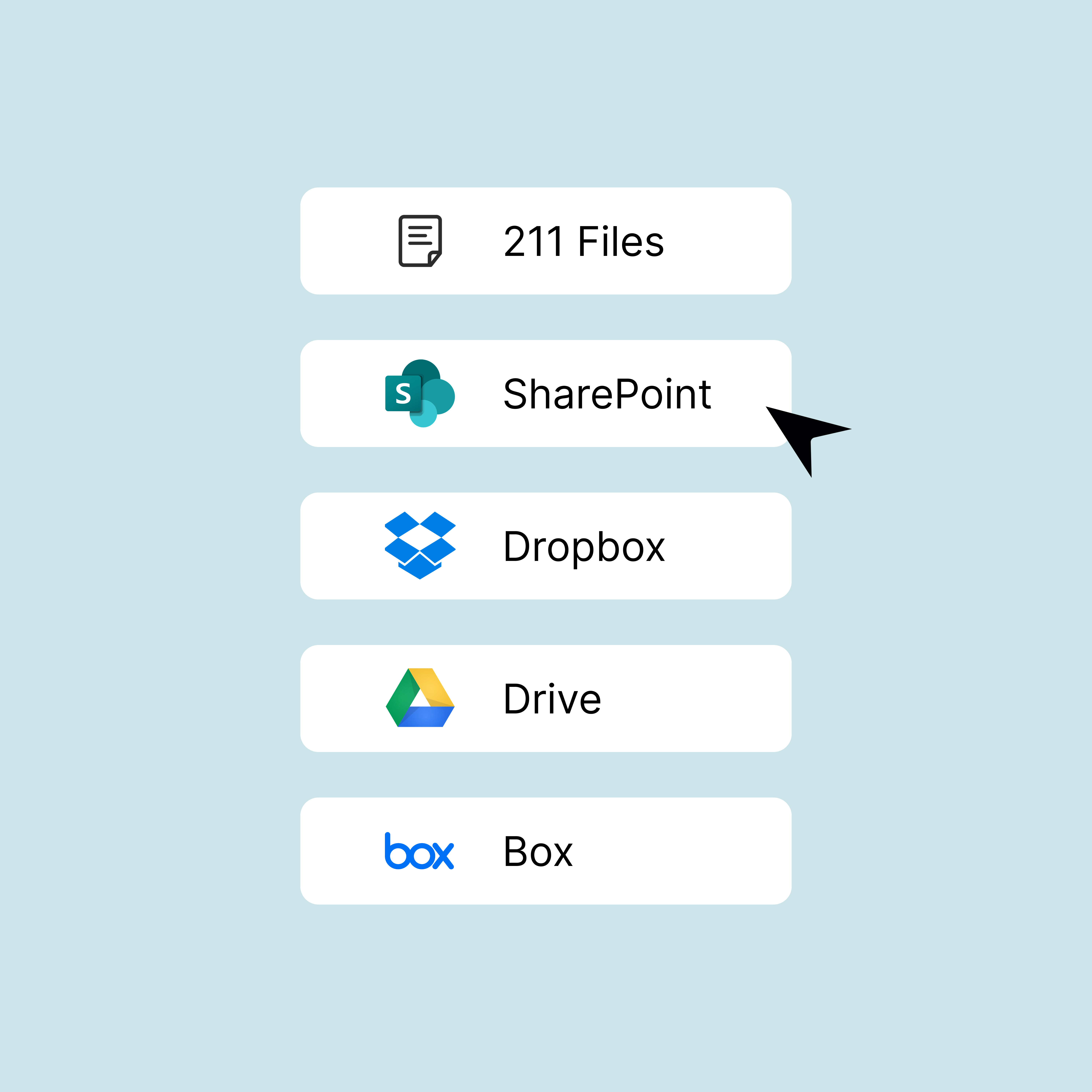

Connect and process data rooms in seconds

Integrate a third-party data room or upload files. Norric automatically classifies, consolidates, and standardizes your firm's data.

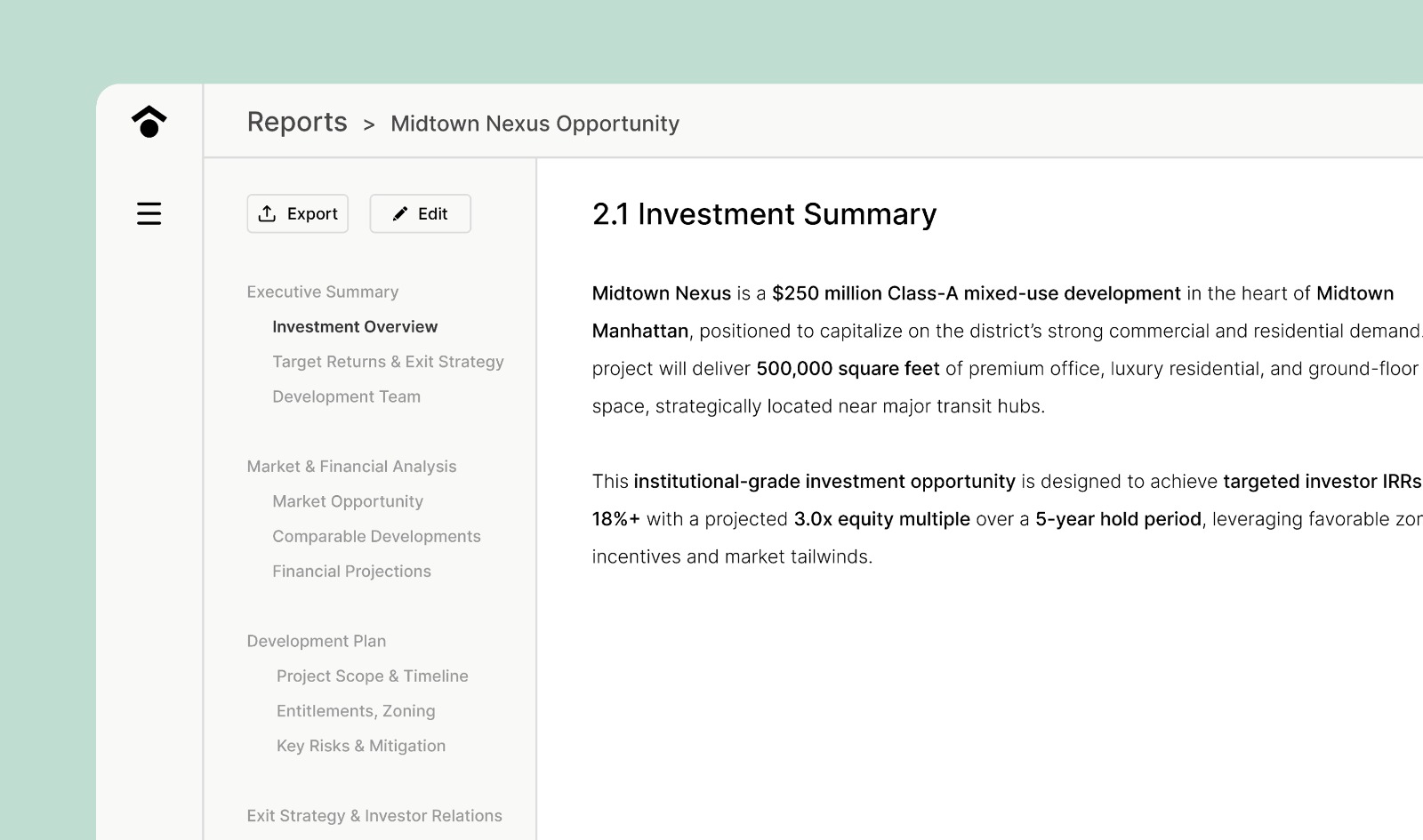

Block is fully integrated into Analyst

Every AI-generated output links back to its source—whether financial models, zoning approvals, or investment memoranda—ensuring transparency and traceability.

Project & File Sharing

Firms can share projects across teams, and invite external stakeholders creating a collaborative knowledge environment.

Frequently asked questions

What does the AI Analyst do?

First, it automatically ingests, standardizes, and labels company information from multiple data sources provided via file upload or external data room integration, including free-form Excel spreadsheets. This information is further enriched with public third-party data and proprietary data from a repository of the lenders’ prior deals to produce a screening dashboard. Next, it completes a credit analysis tailored to the lenders’ credit parameters, outputting one or more customizable credit reports. These reports help lenders better assess how well a given company fits their credit box, benchmark the opportunity against relevant companies, and understand performance risks.

What does the AI Analyst do?

First, it automatically ingests, standardizes, and labels company information from multiple data sources provided via file upload or external data room integration, including free-form Excel spreadsheets. This information is further enriched with public third-party data and proprietary data from a repository of the lenders’ prior deals to produce a screening dashboard. Next, it completes a credit analysis tailored to the lenders’ credit parameters, outputting one or more customizable credit reports. These reports help lenders better assess how well a given company fits their credit box, benchmark the opportunity against relevant companies, and understand performance risks.

What does the AI Analyst do?

First, it automatically ingests, standardizes, and labels company information from multiple data sources provided via file upload or external data room integration, including free-form Excel spreadsheets. This information is further enriched with public third-party data and proprietary data from a repository of the lenders’ prior deals to produce a screening dashboard. Next, it completes a credit analysis tailored to the lenders’ credit parameters, outputting one or more customizable credit reports. These reports help lenders better assess how well a given company fits their credit box, benchmark the opportunity against relevant companies, and understand performance risks.

What does the AI Analyst do?

First, it automatically ingests, standardizes, and labels company information from multiple data sources provided via file upload or external data room integration, including free-form Excel spreadsheets. This information is further enriched with public third-party data and proprietary data from a repository of the lenders’ prior deals to produce a screening dashboard. Next, it completes a credit analysis tailored to the lenders’ credit parameters, outputting one or more customizable credit reports. These reports help lenders better assess how well a given company fits their credit box, benchmark the opportunity against relevant companies, and understand performance risks.

What does the AI Analyst do?

First, it automatically ingests, standardizes, and labels company information from multiple data sources provided via file upload or external data room integration, including free-form Excel spreadsheets. This information is further enriched with public third-party data and proprietary data from a repository of the lenders’ prior deals to produce a screening dashboard. Next, it completes a credit analysis tailored to the lenders’ credit parameters, outputting one or more customizable credit reports. These reports help lenders better assess how well a given company fits their credit box, benchmark the opportunity against relevant companies, and understand performance risks.

We’re building a future where real estate analysis that once took weeks can be done in minutes.

Through partnerships with leading real estate developers, institutional investors, and private equity firms, Norric is redefining how AI is applied to real estate decision-making.